In recent months, and especially after the Corporate Transparency Act became effective on January 1, 2024, banks have been auditing the physical addresses on file with their customers’ bank accounts.

Mercury is one bank that we have seen causing ripples in the international community. The bank used to be one of the favorites for internationals when it comes to opening business bank accounts. However, after they switched to a new underwriting bank last year, it is now significantly more difficult to open a business bank account there.

Furthermore, in recent months, Mercury has also been going back and auditing all the addresses for their customers. Many customers are now getting requests to provide proof of physical address for Mercury bank.

What do you do if you are getting asked by Mercury to provide such documents?

Note that all the information and recommendations below is all for Mercury bank specifically. Other banks have their own underwriting criteria and have their own restrictions.

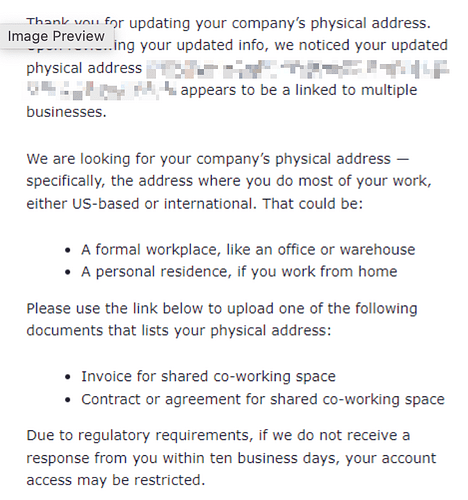

Our first recommendation is to follow what Mercury allows you to do. Here’s a sample email that Mercury sends out to customers:

Based on the email, you can use your international home address to satisfy your physical address requirement. U.S. based address is not required. It will depend on whether your country is accepted by Mercury in this case.

Our second recommendation, which is not really a solution but more of an advice, is to NOT work with Mercury moving forward. I know that Mercury is very popular for internationals because they used to be less strict than other banks. But that’s no longer the case here and in fact, they are MORE restrictive than other banks at this time. I would recommend that you start looking at other banks and options.

You can try other fintech banks like Relay, but it’s my experience that fintechs generally are not the best choices to go with simply because they use an underwriting bank that may have different objectives from the fintechs’ own interests. Underwriting banks for fintechs are normally more restrictive these days than traditional banks. If you were to go with traditional banks, you will likely have fewer issues in the future even if they are strict at the beginning.

What you might want to do now or in the near future

If you’re international and you have a stable business, I would highly recommend that you have at least 2 bank accounts. In case one decides to flag you or close your account, your business won’t be affected since you can switch to the other bank while you resolve the issue with the problematic bank or look for a new bank.